If you’ve received a text message claiming to be from your state’s Department of Motor Vehicles, you’re not alone. Millions of Americans receive suspicious DMV text messages every month, and most of them are scams.

The question “does the DMV send text messages” has become increasingly important as fraudsters get more sophisticated with their tactics. This comprehensive guide will help you understand when the DMV actually texts you, how to identify fake messages, and exactly what to do if you’ve already fallen victim to a scam.

Table of Contents

The Direct Answer: Does the DMV Send Text Messages?

Yes, the DMV does send text messages—but only under very specific circumstances. The critical point you need to understand is this: the DMV will never send you unsolicited text messages. If you didn’t initiate contact with the DMV, any text claiming to be from them is almost certainly a scam.

According to official statements from multiple state DMV agencies, the only time you’ll receive a legitimate DMV text is when you’ve actively requested a service or made an appointment. For example, if you scheduled a DMV appointment online, they might send you a confirmation or reminder text. However, they will absolutely never ask you to verify personal information, click suspicious links, or provide your Social Security number via text message.

The surge in DMV text scams has become a nationwide epidemic. The FBI Internet Crime Complaint Center (IC3) reported receiving over 60,000 complaints related to smishing scams impersonating government agencies like the DMV in just the first half of 2024 alone. This represents a dramatic increase from previous years, making it essential for every driver to understand how these scams work.

The most important distinction to remember: legitimate DMV communications will never create urgency through threats or demand immediate payment via text. If a text is trying to scare you into taking action, it’s a scam.

When the DMV Actually WILL Text You (vs. Won’t)

One of the biggest gaps in competitor content is the lack of clarity about what legitimate DMV communications actually look like. Let me break this down clearly so you know exactly what to expect.

Official DMV Text Types

The DMV uses text messaging for very limited, specific purposes. Here’s what you might legitimately receive:

- Appointment Confirmations: If you book an appointment online or by phone, the DMV may text you a confirmation code or reminder. This text will only contain the appointment date, time, and location—nothing more. It won’t ask for personal information or direct you to a link.

- Appointment Reminders: The day before or a few hours before your appointment, you might receive a reminder text to confirm you’re still coming. Again, this is purely informational and won’t request any data.

- Service Status Updates: If you’re waiting for a document like a license renewal, registration, or title transfer, the DMV might text you with a status update—but only if you requested that service initially.

- Cancellation Notices: If you need to cancel an appointment or a service is unavailable, the DMV might text this information to you.

The key characteristic of all legitimate DMV texts? They are brief, informational, and never request sensitive information.

When They Contact You

Legitimate DMV contact happens when:

- You initiated the contact first

- You scheduled an appointment

- You requested a service

- You asked them to notify you of a status update

- You enrolled in a notification program through their official website

Legitimate DMV contact will never:

- Come unsolicited (out of the blue)

- Ask for your Social Security number

- Request your driver’s license number

- Ask for banking or credit card information

- Direct you to click a link

- Demand immediate payment

- Threaten license suspension or prosecution

- Include a shortened URL

- Use poor grammar or spelling

- Create artificial urgency

The 7 Latest DMV Text Scams to Watch (2025)

This is where competitors fall short—they often mention only 3-5 scam types. Here are seven distinct DMV scam text variations currently circulating, including new ones that emerged in late 2024 and early 2025.

Scam #1: Unpaid Traffic Ticket / Fine Threat

What it says: “Your vehicle has an outstanding violation. You owe $XXX. Visit [link] to pay immediately or your license will be suspended.”

Why it works: People panic when they think they might have missed a ticket. The threat of license suspension is powerful social engineering that forces quick decisions.

Red flags:

- Demands immediate payment

- Uses threatening language

- Includes a shortened URL

- Mentions “DMV violation database”

- Threatens legal action or prosecution

- Mentions a 35% service fee for late payment

This phishing text preys on the fact that some people genuinely do owe traffic violations, so they’re more likely to respond without thinking critically.

Scam #2: License Non-Compliance with Federal Rules

What it says: “Your Driver License Holder account does not comply with federal guidelines. Update your information immediately at [link] to keep your license active.”

Why it works: This uses confusion about real requirements (like REAL ID compliance) to seem legitimate. The message creates urgency and plays on people’s fear of losing driving privileges.

Red flags:

- Grammatical errors (“Driver License Holder” capitalization)

- Vague references to “federal guidelines”

- Link doesn’t go to official DMV website

- Creates false urgency about license status

- Uses domain like “.in” (India) instead of official state domain

This spoofed text message is designed to steal your personal information for identity theft purposes.

Scam #3: DMV Refund or Overpayment Scam

What it says: “The DMV is holding a refund for you due to overpayment of fees. Confirm your payment details at [link] to receive your refund immediately.”

Why it works: People love the idea of getting money back, so they act without hesitation. This classic credential theft scheme exploits greed and inattention.

Red flags:

- Promises unexpected money

- Creates artificial time pressure (“immediately”)

- Requests banking information

- Uses official-looking formatting but suspicious links

- The “refund” is too good to be true

No legitimate agency will offer refunds via unsolicited text messages.

Scam #4: Fake Appointment Reminder

What it says: “Reminder: Your DMV appointment is scheduled for [date] at [time]. Confirm your visit at [link].”

Why it works: This is particularly dangerous because if you actually have an appointment scheduled, you’ll click the link thinking it’s real. Even if you don’t have an appointment, you might click to cancel or get more information.

Red flags:

- You didn’t schedule this appointment

- Link takes you to a fake website asking for identification information

- Website design doesn’t match official DMV site

- Asks for sensitive data like driver’s license number or date of birth

- The URL doesn’t match official DMV domain (should be dmv.[state].gov)

Scam #5: REAL ID Cancellation Threat

What it says: “Your REAL ID has been cancelled due to document verification issues. Resubmit your documents immediately at [link] or lose your valid ID.”

Why it works: The REAL ID requirement is confusing to many people, and scammers exploit this confusion. The threat of having your ID cancelled is frightening enough to make people act fast without thinking.

Red flags:

- References REAL ID but with inaccurate information

- Creates panic about ID validity

- Asks you to resubmit sensitive documents

- Link goes to fraudulent website

- Legitimate REAL ID issues are handled through official website, not text

This phishing attack specifically targets the confusion many people have about federal ID requirements.

Scam #6: “Fuel Rebate” or Tax Refund Scam

What it says: “Claim your fuel rebate now! You’re eligible for $1,500 in fuel credits for your vehicle. Visit [link] to apply. Offer expires in 24 hours.”

Why it works: During times of high gas prices, this offer is extremely tempting. The artificial deadline and huge financial incentive drive people to click without verifying.

Red flags:

- Offer is unrealistically generous ($1,500 fuel credits don’t exist)

- Artificial time deadline (“expires in 24 hours”)

- Suspicious spelling like “NewYorkDMV” (no spaces, capitalization errors)

- Link is shortened or suspicious

- Too good to be true is always the correct assessment

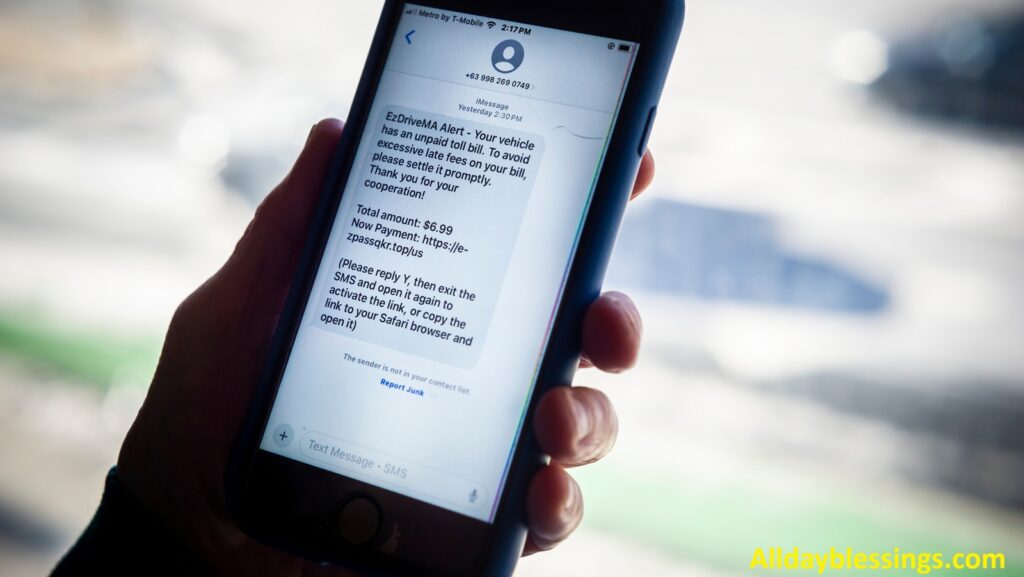

Scam #7: E-ZPass or Toll Payment Scam

What it says: “You have an unpaid toll balance of $XX.XX on your E-ZPass account. Pay immediately at [link] or your vehicle registration will be suspended.”

Why it works: E-ZPass users are specifically targeted because many people use tolls regularly and might have actually incurred charges. The specific reference to their actual account type makes it seem more legitimate.

Red flags:

- Mentions specific toll agency or E-ZPass by name

- Demands immediate payment

- Uses shortened URLs

- Creates urgency about vehicle registration

- Email address or phone number looks official but isn’t

This scam often combines smishing (SMS phishing) with vishing attempts, where follow-up calls from scammers attempt to extract additional information.

How to Spot a Fake DMV Text (Red Flags Checklist)

Rather than listing vague warning signs, here’s a comprehensive, actionable checklist you can use immediately when you receive any suspicious message.

Grammar and Spelling Errors

Red flag indicators:

- Unusual capitalization (Driver License, Visit, Updated)

- Spelling mistakes or typos

- Awkward phrasing that doesn’t match official communications

- Missing punctuation or incorrect punctuation

Professional government communications don’t contain these errors. If something looks off grammatically, it almost certainly is a scam.

Suspicious Links and Shortened URLs

This is one of the biggest red flags that competitors don’t emphasize enough. Here’s what to watch for:

Dangerous link patterns:

- Shortened URLs (bit.ly, tinyurl, goo.gl) that hide the actual destination

- URLs that don’t match official DMV domain (legitimate: dmv.ca.gov, dmv.ny.gov, dmv.texas.gov)

- Links using unusual domain extensions (.in for India, .ru for Russia)

- URLs with typos (dmv-ny.com instead of dmv.ny.gov)

- Links embedded in the text that create pressure to click

- URLs that redirect you multiple times before landing on a fake website

Always verify: If you receive a text with a link, never click it. Instead, go directly to your state’s official DMV website by typing the address in your browser. Use the contact information listed on that official site, not anything from the suspicious text.

Threatening Language and Artificial Urgency

Scammers use social engineering psychology to short-circuit your critical thinking. Watch for:

- Phrases like “Act immediately,” “24-hour deadline,” “Urgent action required”

- Threats about license suspension or vehicle registration cancellation

- References to legal prosecution or lawsuits

- Statements about credit score damage

- Mentions of fines, penalties, or additional fees

- Language that creates fear or panic

Legitimate government agencies don’t send threatening texts creating false urgency. They have legal processes and would contact you through official channels first.

Requests for Personal Information

The most important rule: The DMV will never ask for personal information via text. Not ever. This includes:

- Social Security number (SSN)

- Driver’s license number

- Date of birth

- Address or phone number

- Credit card or banking information

- Passport information

- Email address (in response to a suspicious text)

If a text asks for ANY of this information, it’s 100% a scam. Delete it immediately.

Unsolicited Messages You Didn’t Expect

Critical distinction: If you didn’t initiate contact with the DMV, any text from them is suspicious unless you’re absolutely certain you requested an appointment confirmation.

Domain Mismatches and Fake Logos

When you click on a link (which you shouldn’t), here’s how to spot the phishing website:

- Official DMV site uses .gov domains (dmv.ca.gov, not dmv-ca.com)

- Fake sites sometimes steal the official logo or design elements

- Check the favicon (small icon next to the URL) to see if it matches the real site

- Real DMV sites have security certificates and use HTTPS

- Scammers now also use HTTPS and SSL certificates, so don’t trust security indicators alone

- The URL bar shows something suspicious when you look closely

The 35% Service Fee Red Flag

One specific indicator that competitors mention but don’t emphasize: any mention of a “35% service fee” or similar additional charges is a massive red flag. The DMV doesn’t charge percentages for late payments in text-based payment schemes.

Step-by-Step: What to Do If You Received a Scam Text

This is critical content that most competitors treat too briefly. Here’s exactly what you should do depending on your situation.

If You Clicked the Link (But Didn’t Submit Information)

Immediate actions (within minutes):

- Stop immediately. Close the browser or app without entering any information.

- Don’t submit any forms. Even if the page looks official, do not enter your name, address, ID number, or any personal data.

- Clear your browser history and cache. On iPhone: Settings > Safari > Clear History and Website Data. On Android: Chrome > Settings > Privacy > Clear browsing data.

- Disconnect from the network. If you’re on Wi-Fi, disconnect immediately. The website might have attempted to install malware on your device.

- Run antivirus software. Download and run reputable anti-malware software like Malwarebytes to scan your device for any malicious code. This is crucial because some fake DMV sites deliver malware without you realizing it.

- Monitor your device. Watch for unusual activity, unexpected app installations, or strange behavior over the next few weeks.

- Change your passwords (only on a different device). Update passwords for important accounts like email, banking, and social media, but do this on a clean device to avoid the malware-infected one.

Why this matters: Even visiting a phishing website can potentially allow scammers to install tracking software or steal data from your device.

If You Provided Personal Information

This is serious. Here’s your action plan:

Within the first hour:

- Call your bank and credit card companies immediately. Use the phone number on the back of your card, not any number from the scam text. Tell them you’ve been targeted by a scam and ask them to watch your account for suspicious activity.

- Place a fraud alert on your credit. Contact one of the three major credit bureaus (Equifax, Experian, or TransUnion) and request a fraud alert. This makes it harder for scammers to open new accounts in your name. You only need to contact one bureau, and it will alert the others.

- Enable transaction alerts. Ask your bank to alert you via text or email about any transactions, especially large ones or new account openings.

- Monitor your accounts closely. Check your bank statements and credit card transactions for anything unfamiliar.

Within 24 hours:

- Consider a credit freeze. A credit freeze is more comprehensive than a fraud alert. It prevents anyone (including you) from opening new credit accounts in your name without unfreezing first. You can freeze credit with all three bureaus for free.

- Equifax: 1-888-378-4329 or equifax.com

- Experian: 1-888-397-3742 or experian.com

- TransUnion: 1-888-909-8872 or transunion.com

- File a report with the FTC. Go to IdentityTheft.gov and create a detailed report. This is your official documentation that you’ve been a victim of fraud, which you’ll need if there’s any identity theft follow-up.

- Get your free credit reports. Visit annualcreditreport.com (the official site) and check all three credit reports for accounts you don’t recognize. You’re entitled to one free report from each bureau every year.

Within one week:

- Change all important passwords. Update passwords for email (especially important), banking, social media, and any accounts containing sensitive information. Use strong, unique passwords.

- Enable two-factor authentication. On all accounts that offer it, turn on two-factor authentication to add an extra layer of security. This means even if someone has your password, they can’t access your account without a code from your phone.

- Consider identity theft protection. Services like Aura, LifeLock, or IDShield monitor your personal information for signs of identity theft and can help if your information has been compromised.

Ongoing (monthly for 6-12 months):

- Monitor credit reports continuously. Most credit monitoring services offer free trials. Keep watching for accounts you didn’t open.

- Watch for suspicious mail. Scammers who have your personal information might try to open accounts, apply for loans, or commit fraud using your name and address. Watch your mailbox for unexpected bills or account statements.

If You Paid Money

This is the most time-sensitive situation. Here’s what to do:

Within minutes:

- Contact your bank immediately. Call the number on the back of your card. Tell them you’ve been scammed and ask if they can stop the transaction or reverse it if it has already gone through.

- If you used a debit card: Ask your bank to file a dispute immediately. For debit card fraud, you typically have up to 60 days to report it, but the sooner you report, the better your chances of recovery.

- If you used a credit card: Your credit card company has stronger fraud protection laws. The Fair Credit Billing Act limits your liability to $50 if you report fraud promptly. Most modern credit cards actually have zero liability policies.

- If you used a payment app (Venmo, PayPal, Cash App, etc.): Contact the app company immediately and report the fraud. Some of these services can reverse transfers if you act quickly, but not all. Document everything.

- If you sent money through a wire transfer: This is nearly impossible to recover, but contact the receiving bank and report it as fraud anyway. Some banks can freeze accounts if they catch it quickly enough.

Within 24 hours:

- File a report with the FTC at reportfraud.ftc.gov or IdentityTheft.gov. This creates an official record.

- File a police report. Contact your local police department’s non-emergency line and file a report. Get a copy of the report number—you’ll need this for credit monitoring and dispute claims.

- File a report with the FBI Internet Crime Complaint Center (IC3) at ic3.gov. This helps law enforcement track scam patterns.

- Monitor your bank accounts daily. Watch for any additional fraudulent transactions.

Important to know: Recovery of money sent to scammers is difficult, but not impossible. You have the best chance if you:

- Report it immediately

- File official reports with FTC and IC3

- Work with your bank’s fraud department

- Document everything

Some banks and credit card companies have victim protection programs that might help recover funds, especially if you acted quickly.

How to Report DMV Text Scams

Reporting scams is crucial because it helps law enforcement track patterns and warn other potential victims. Here’s exactly where and how to report.

Report to the FCC (Most Immediate)

Forward the text message to 7726 (SPAM). This is the fastest way to report spam texts to your mobile carrier. Simply forward the entire scam message to this number as a text. Your carrier will investigate.

Why this works: Your mobile carrier can track these scams and potentially block them for other customers on their network.

File a Complaint with the FTC

Visit reportfraud.ftc.gov and select “Other scams” or the specific type if available. The FTC compiles this data to identify trends and issue warnings. Your complaint helps them identify the biggest threats.

What to include:

- Full text of the scam message (copy and paste if possible)

- Date and time you received it

- Any phone number or link from the message

- Whether you clicked the link or provided information

- Any money you lost

- Whether you’ve taken steps to protect yourself

Report to the FBI Internet Crime Complaint Center (IC3)

Go to ic3.gov and file a complaint. The IC3 handles cybercrime investigations and reports directly to law enforcement agencies.

Why this matters: If the scam involves federal crimes (which most do), the IC3 can coordinate with state and federal investigators. The more complaints they receive about the same scam pattern, the more resources they dedicate to stopping it.

Contact Your State’s DMV Directly

Report it to your specific state’s DMV fraud department. Most states have a dedicated email address for phishing reports. For example:

- New York DMV: [email protected]

- Many states accept reports through their official website’s “Report Fraud” section

This helps the DMV warn residents about specific scam variations.

Report to Your State Attorney General

Your state’s attorney general’s office often has a consumer protection division that investigates fraud. Some states have specific scam hotlines or online reporting forms.

Protect Yourself Going Forward

The best defense is prevention. Here’s how to significantly reduce your risk of falling victim to DMV scams.

Keep Your Phone Secure

- Enable two-factor authentication on all accounts that offer it, especially email and banking. This adds an extra security layer that makes it harder for hackers to access your accounts even if they somehow get your password.

- Use strong, unique passwords. Don’t reuse passwords across accounts. Consider using a password manager like Bitwarden, 1Password, or LastPass to generate and store complex passwords.

- Keep your phone’s operating system updated. Apple and Google release security patches regularly. Install them as soon as they’re available. Go to Settings > About > Software Update on most phones.

- Install reputable antivirus software. Programs like Malwarebytes, Norton Mobile Security, or McAfee mobile versions provide real-time protection against malware threats.

Practice Smart Texting Habits

- Never click links in unexpected texts. If you get a text that seems to be from a government agency, company, or bank you do business with, go directly to their official website instead of clicking any links in the text. This smishing prevention technique is your best defense.

- Be suspicious of urgency. Legitimate organizations don’t create artificial time pressure through text messages. If a text is trying to make you act fast, it’s probably a scam.

- Watch for spoofed numbers. Scammers can make texts appear to come from legitimate numbers using spoofing technology. Even if the number looks official, it might not be. Never trust the sender based on the number alone—verify through official channels instead.

- Block and report. Most phones have options to block numbers and report them as spam. Use these features liberally.

Verify Everything Directly

- When in doubt, verify independently. If a text claims to be from the DMV and mentions something urgent, call your DMV directly using the number from their official website—not any number in the text. This takes 5 minutes and completely confirms whether it’s real.

- Use official websites, not links from texts. Always navigate to official government websites by typing the address yourself or searching “official [state] DMV website” in Google.

- Ask yourself if it makes sense. Would the DMV really demand immediate payment via text? Would they threaten you before giving you a chance to respond? Real organizations follow due process. Scammers use psychological pressure.

Monitor Your Accounts

- Check credit reports regularly. Get your free annual report at annualcreditreport.com and review it carefully for accounts you don’t recognize. Consider checking quarterly if you’ve been targeted by scams.

- Review bank and credit card statements monthly. Look for any unauthorized charges. Report anything suspicious to your bank immediately.

- Set up account alerts. Most banks and credit card companies offer free alerts for transactions over a certain amount, new account openings, or password changes. Use these.

Educate Others

- Share this information. DMV scams are so common now that everyone needs to know about them. Share this article with family, friends, and colleagues. Warn older adults specifically—they’re disproportionately targeted by scams.

- Report scams you encounter. If someone you know falls victim, encourage them to report it through the proper channels. Every report helps law enforcement identify and stop these operations.

The Psychology Behind Why People Fall for DMV Scams

Understanding the psychological mechanisms that make these scams work is crucial. Scammers use several proven techniques:

- Authority bias: People trust messages that appear to come from government agencies. We’re conditioned to respond to authority, which is exactly what scammers exploit.

- Urgency and scarcity: Creating artificial time pressure forces people to skip their critical thinking. “Act within 24 hours” sounds urgent and official.

- Fear motivation: Threats about license suspension, prosecution, or credit damage trigger fear responses that bypass rational decision-making.

- Specific details: Mentioning real terms like “E-ZPass,” “REAL ID,” or “DMV violation database” makes scams seem more legitimate because they contain accurate information mixed with malicious intent.

- Reciprocity and greed: Offering fake refunds or fuel rebates exploits people’s natural attraction to money and the feeling that they “should” respond to an offer.

Understanding these techniques makes you much less likely to fall for them because you’ll recognize the pattern.

Recovery Timeline After Compromise

One thing no competitor explains clearly: how long does it take to fully recover? If you’ve given personal information to scammers, here’s what to expect:

- First 30 days: Peak risk period for identity theft and fraud. Scammers either use your information immediately or sell it to others who will.

- 30-90 days: Monitor closely during this window. This is when fraudulent accounts or charges typically appear. Credit monitoring services are particularly important here.

- 90 days – 1 year: Ongoing risk, though lower. Credit freezes and alerts remain important. Continue monitoring credit reports.

- 1-2 years: Some identity theft schemes take months to materialize. A scammer might have your Social Security number and driver’s license information but only use it a year later when they need to take out a loan.

- Ongoing: Once your information is compromised, it’s compromised forever. Continue annual credit report reviews and monitoring indefinitely.

State-by-State Variations

DMV scams vary slightly by state. Some states are targeted more heavily:

| State | Primary Scam Type | Most Common Threat |

| New York | Unpaid toll/E-ZPass | License suspension |

| California | REAL ID non-compliance | Federal violation |

| Florida | Traffic violation | 35% late fee |

| Texas | Vehicle registration | Registration suspension |

| Pennsylvania | E-ZPass debt | Toll collection |

| Virginia | Unpaid ticket | License revocation |

| Maryland | Toll booth scam | Vehicle impound |

| Indiana | DMV appointment | Personal data theft |

Being aware of your state’s most common scam variation helps you stay vigilant.

Frequently Asked Questions About DMV Text Scams

Can I get my money back if I paid a scammer?

Recovery depends on how you paid. Credit card payments have better protection than debit cards. Wire transfers are nearly impossible to recover. Contact your bank immediately—the faster you report, the better your chances. Some banks have victim protection programs that reimburse fraud losses.

What if I only gave them my phone number?

A phone number alone is less critical than other information, but it’s still problematic. Scammers can use it to send more scam messages, sell it to other fraud operations, or use it in other scams. Update your number with institutions you do business with, enable two-factor authentication on accounts using that number, and monitor for other contact.

Is my device infected if I clicked a link?

Not necessarily, but there’s a risk. Immediately run anti-malware software to check. If the fake website installed anything or if your device behaves strangely afterward, you likely have malware. Consider taking it to a professional if you’re not tech-savvy.

Will the DMV sue me if I don’t pay?

No. Legitimate DMV agencies don’t demand payment via threatening text messages. This is 100% how you know it’s a scam. Real legal action involves official notices sent through the mail, court appearances, and due process.

Can I block these texts?

Yes. Most phones let you block numbers and report them as spam. However, scammers use spoofed numbers, so blocking one number won’t stop them completely. Don’t mark legitimate-looking texts as “not spam” even if they seem official—when in doubt, verify independently.

What if I’m getting repeatedly targeted?

If you receive multiple scam texts, you’ve probably been added to a scammer’s list. Report all of them to 7726 and consider:

- Changing your phone number (nuclear option, usually not necessary)

- Using a “do not call” registry (though this is primarily for calls, not texts)

- Enabling “Filter Unknown Senders” on iPhone or “Spam Protection” on Android

- Never responding to scam texts (this confirms your number is active)

Does the DMV ever use shortened URLs in legitimate texts?

Absolutely not. Shortened URLs (bit.ly, tinyurl, etc.) are a red flag indicating a phishing attempt. Real DMV communications, if they include links at all, would use the full official domain.

Conclusion: Stay Alert, Not Paranoid

DMV text scams are real, widespread, and increasingly sophisticated. But you don’t need to be paranoid about every text—you just need to be informed and cautious.

Remember these key principles:

- The DMV never sends unsolicited texts demanding action. If you didn’t initiate contact, don’t engage.

- When in doubt, verify independently. Call your DMV directly using a number you look up yourself.

- Act immediately if you’ve been compromised. The faster you report fraud and take protective steps, the better your chances of minimizing damage.

- Share this knowledge. Help protect others by warning them about smishing scams and social engineering tactics.

- Monitor your accounts. Regular credit monitoring and statement reviews catch problems early.

The good news? By understanding how these phishing attacks work and staying vigilant, you can avoid becoming a victim. The tactics scammers use are predictable once you know what to look for.

If you receive a suspicious text claiming to be from your DMV, does the DMV send text messages like this? Trust your instincts. If something feels wrong, it almost always is. Delete it, report it to 7726 and the FTC, and move on with your day knowing you’ve protected yourself and helped law enforcement stop these criminals.

Stay safe out there, and remember: when it comes to government agencies and personal information, always verify independently.

I’m Watson, a faith-inspired writer passionate about sharing heartfelt blessings and uplifting words that bring peace, gratitude, and hope. Through my daily blessings, I aim to comfort the soul and inspire spiritual growth.