Managing your Tractor Supply credit card doesn’t require trips to physical locations anymore. The digital revolution transformed how cardholders interact with their accounts through dedicated online portals.

Tsccard.accountonline com serves as the primary gateway for TSC store card holders seeking convenient access to their financial information. This specialized platform eliminates the frustration of waiting for mailed statements while providing immediate visibility into purchases and balances. Cardholders discover unprecedented control over their consumer accounts through this streamlined interface.

The portal represents a partnership between Tractor Supply Company and Citi Retail Services, which operates the backend infrastructure for TSC credit cards. Users gain comprehensive capabilities including viewing transaction history, scheduling payments, and monitoring rewards accumulation.

The system handles everything from veterinary service purchases to feed and farm supply transactions with equal efficiency. Security protocols embedded within the platform protect sensitive financial data while maintaining accessibility across devices. Whether you’re tracking activity on recent purchases or setting up automated payment schedules, this consumer payment hub centralizes all essential functions.

Table of Contents

What is tsccard.accountonline.com?

The tsccard.accountonline.com domain functions as a specialized subdomain within the broader accountonline.com ecosystem. This architecture allows Citi Retail Services to manage multiple retail card programs through a unified technological infrastructure. The Tractor Supply partnership leverages this established platform to deliver banking-grade security alongside intuitive navigation.

Cardholders access features specifically tailored to TSC® shopping patterns and financing options. The subdomain designation ensures that Tractor Supply stores customers receive branded experiences while benefiting from enterprise-level payment processing capabilities.

Citi Retail Services orchestrates the technical operations behind this credit card account management system. Their expertise spans decades of retail banking, bringing institutional knowledge to store card administration. The platform processes millions of transactions monthly across various retail partnerships while maintaining separate account silos for each brand.

TSC credit card holders interact with interfaces designed around rural lifestyle spending categories including livestock supplies, agricultural equipment, and veterinary services. This specialization distinguishes the portal from generic banking websites that lack context about farm supply purchasing patterns.

Typical users accomplish several critical tasks through this digital help center. Viewing current balances helps manage budgets before making additional purchases at any of the nationwide Tractor Supply locations. Statement downloads provide records for tax purposes or expense tracking. The payment submission feature accepts various funding sources for settling monthly obligations.

New applicants explore card offerings and submit applications directly through integrated forms. Existing customers modify personal information, update phone numbers, and adjust notification preferences. The portal essentially replaces nearly every function previously requiring telephone calls or postal correspondence with the consumer payment dept.

Why It Matters

Convenience stands as the paramount advantage of online account management compared to antiquated paper-based systems. Cardholders no longer wait days for postal delivery of critical statements or payment confirmations. The instant accessibility means checking your credit status takes seconds rather than navigating telephone menus or visiting stores during limited business hours.

Busy farmers, ranchers, and rural homeowners appreciate scheduling payments during late evening hours when chores conclude. The digital approach aligns perfectly with modern expectations for financial transparency and control over consumer accounts.

Security concerns elevate the importance of utilizing official domains rather than clicking unverified links. Phishing schemes frequently impersonate financial institutions through deceptive URLs hoping to harvest login credentials. The authentic tsccard.accountonline.com portal employs encryption protocols that safeguard transmitted data from interception.

Using bookmarked official addresses prevents accidentally surrendering your password to malicious actors. This matters tremendously for protecting credit approval status and preventing unauthorized charges. The platform serves both existing cardholders managing their TSC store card and prospective customers researching whether the card benefits align with their spending habits at gas stations, grocery stores, and agricultural suppliers.

Understanding How the Portal Works

URL and Sub-domain Details

The tsccard.accountonline.com subdomain architecture demonstrates sophisticated retail banking infrastructure. This configuration allows the parent domain accountonline.com to host multiple retail credit programs under distinct subdomains. Each retail partner receives branded experiences while sharing underlying security and processing technologies.

The system efficiently routes Tractor Supply credit card users to appropriate interfaces without exposing backend complexities. Technical investigations reveal the subdomain points to servers maintained by financial services specialists rather than Tractor Supply directly.

Accountonline.com operates as a comprehensive platform serving numerous retail card issuers beyond just TSC. Similar subdomain structures exist for other merchants partnering with Citi Retail Services for their store financing programs. This economies-of-scale approach delivers enterprise-grade features to individual retailers without each building proprietary systems.

The standardization ensures consistent security protocols across all partner programs while allowing customization for specific merchant needs. Users navigating to the TSC® credit card portal encounter familiar Citi authentication methods used across their entire retail portfolio.

Redirects and Server Details

Login attempts at tsccard.accountonline.com frequently trigger redirects to secure Citi Retail Services authentication servers. This architectural decision centralizes credential verification while distributing account management functions.

The redirection happens seamlessly within milliseconds, creating an uninterrupted user experience. Security certificates validate during these transitions to prevent man-in-the-middle attacks. Technical analyses indicate server infrastructure hosted at IP address 23.9.184.31 within United States data centers, ensuring compliance with domestic banking regulations.

The hosting arrangement prioritizes uptime reliability critical for payment processing windows. Redundant server configurations prevent single points of failure that could block urgent delivery/express payments attn to the consumer payment dept. Geographic distribution of servers optimizes response times regardless of whether users connect from rural Sioux Falls or urban Philadelphia.

The infrastructure handles peak traffic during monthly billing cycles when thousands simultaneously submit payments before due dates. This robust technical foundation supports the TSC credit cards ecosystem across all Tractor Supply stores locations.

| Technical Specification | Details |

|---|---|

| Primary Domain | tsccard.accountonline.com |

| Parent Platform | accountonline.com |

| Server IP Example | 23.9.184.31 (US-based) |

| Operator | Citi Retail Services |

| Security Protocol | HTTPS with SSL/TLS encryption |

| Redirect Destination | Secure Citi authentication servers |

What You Can Do After Logging In

Successful authentication unlocks comprehensive account oversight capabilities previously unavailable through traditional methods. The dashboard displays current balances reflecting recent purchases at farm supply outlets or online orders. Transaction histories reveal spending patterns across categories like veterinary services, equipment, and seasonal merchandise. Statement archives stretch back months, providing documentation for warranty claims or return processing. The interface presents information hierarchically, prioritizing actionable items like upcoming payment deadlines.

Payment submission functionality represents the portal’s most frequently utilized feature. Cardholders select one-time payment options for immediate processing or establish recurring schedules aligned with paycheck deposits. The system accepts funding from checking accounts, savings accounts, and even other credit cards in certain circumstances. Confirmation numbers generate instantly upon successful submission, creating audit trails for financial records. Minimum payment amounts display prominently alongside statement balances, helping users avoid late fees that accumulate from missed deadlines. Some users schedule delivery/express payments attn the consumer payment dept well before due dates to ensure processing completes despite potential delays.

Registration management tools let existing cardholders update contact preferences and notification settings. Email alerts notify about approaching due dates, suspicious activity, or special promotional offers. Phone number updates ensure customer service representatives can reach cardholders regarding urgent account matters. Paperless billing enrollment eliminates physical statement mailings while supporting environmental sustainability. Security settings include password modifications and answers to verification questions used during authentication challenges. The personalization transforms generic banking portals into tailored financial command centers.

Step-by-Step: How to Log In

Preconditions: What You Need

Accessing your TSC credit card account requires specific credentials established during initial registration. Your User ID serves as the primary identifier distinguishing your account from millions of other consumer accounts within the Citi Retail Services ecosystem. This alphanumeric string typically reflects personal preferences while meeting security complexity requirements. The password component demands greater sophistication, combining uppercase letters, lowercase characters, numbers, and symbols into memorable yet secure phrases. Both credentials remain case-sensitive, meaning exact capitalization matters during entry.

Physical possession of your card isn’t mandatory for online access once registration completes. However, having your Tractor Supply credit card nearby helps verify account numbers if questions arise during login attempts. Some security protocols require entering the last four digits of your Social Security Number or ZIP code as additional verification layers. Mobile device users benefit from password manager applications that securely store credentials and auto-fill login forms. These preparation steps minimize frustration and reduce the likelihood of triggering account lockouts from repeated failed attempts.

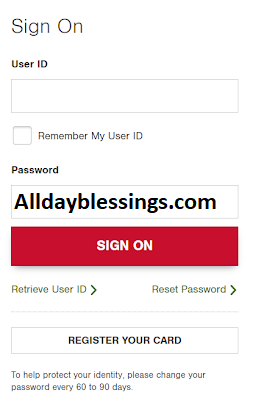

Step-by-Step Login Process

Navigate directly to https://tsccard.accountonline.com using your preferred web browser for accessing the TSC store card portal. Typing the URL manually rather than relying on search engine results eliminates risks of clicking spoofed links masquerading as legitimate banking sites.

The homepage presents a clean interface emphasizing the login form prominently above informational content about card benefits. Users encounter fields clearly labeled for User ID entry followed by password input. The design prioritizes accessibility across devices ranging from desktop computers to smartphones.

Enter your established User ID into the designated field, carefully verifying spelling and capitalization before proceeding. The subsequent password field masks characters for privacy protection, displaying asterisks or dots instead of actual letters. Double-check your typing since several incorrect attempts trigger temporary account suspension as a security measure.

Some implementations require solving CAPTCHA puzzles proving human interaction rather than automated bot activity. After completing all fields accurately, click the “Log In” button to initiate authentication. The system processes credentials against encrypted databases maintained by Citi Retail Services.

Two-factor authentication may activate depending on your security settings or when logging from unrecognized devices. This additional verification step typically involves receiving a numeric code via text message to your registered phone number or through email. Enter the temporary code within the specified timeframe, usually five to ten minutes before expiration. This security layer dramatically reduces unauthorized access risks even if someone obtains your password. Successful verification redirects you to the personalized dashboard displaying your credit card account summary.

| Login Step | Action Required | Security Note |

|---|---|---|

| 1. URL Entry | Type https://tsccard.accountonline.com | Verify HTTPS padlock icon |

| 2. User ID | Enter registered username | Case-sensitive entry |

| 3. Password | Input secure password | Masked character display |

| 4. Verification | Complete CAPTCHA if prompted | Proves human interaction |

| 5. Two-Factor | Enter code from phone/email | Time-limited validity |

| 6. Access | Dashboard loads | Review account summary |

What to Do If You Face Issues

Forgotten User IDs plague even the most organized cardholders occasionally. The login page includes a “Forgot User ID” link specifically addressing this common predicament. Clicking this option launches a recovery workflow requiring alternate verification methods. You’ll provide your card number, name exactly as printed on the Tractor Supply credit card, and potentially identifying information like your date of birth. The system cross-references these details against account records before revealing your User ID or sending it to your registered email address.

Password recovery follows similar protocols but demands more stringent verification given the security sensitivity. The “Forgot Password” link initiates multi-step authentication confirming your identity before allowing reset. Expect to answer security questions established during initial registration, such as your first pet’s name or childhood street address. Successfully passing these challenges enables creating a new password meeting current complexity requirements. The system forces immediate implementation of the new credentials, invalidating all previous passwords to prevent unauthorized access using old authentication.

Account lockouts resulting from excessive failed login attempts require patience or customer service intervention. Most systems implement automatic unlocks after thirty minutes to several hours depending on security policies. Attempting additional logins during lockout periods only extends the restriction duration. Contacting the help center via phone numbers listed on official Tractor Supply websites can expedite resolution. Representatives verify your identity through account-specific questions before manually releasing the lock. This inconvenience ultimately protects your consumer accounts from brute-force hacking attempts systematically trying password combinations.

Browser compatibility issues occasionally disrupt even correct credential entries. Outdated browsers lack security certificates required for modern encryption protocols. Clearing cookies and cache eliminates corrupted data interfering with authentication processes. Disabling browser extensions temporarily helps identify conflicts with password managers or security plugins. Network connectivity problems sometimes manifest as login failures despite correct credentials. Testing internet connections and trying cellular data instead of problematic WiFi networks resolves many mysterious access issues.

Security Tips During Login

Verifying the URL displays https://tsccard.accountonline.com exactly prevents falling victim to sophisticated phishing operations. Scammers create lookalike domains substituting characters or adding extra words hoping inattentive users surrender credentials. The padlock icon appearing in the browser address bar confirms encryption activation protecting transmitted data. Clicking the padlock reveals certificate details issued to legitimate Citi Retail Services domains. These visual confirmations take seconds yet provide crucial assurance you’re interacting with authentic Tractor Supply credit card infrastructure.

Public WiFi networks present significant security vulnerabilities despite convenience when checking accounts away from home. Coffee shops, airports, and libraries often operate unsecured connections allowing tech-savvy criminals to intercept data transmissions. Avoid accessing financial accounts through these networks or use virtual private network (VPN) services encrypting all internet traffic.

Cellular data connections typically provide superior security compared to public hotspots. Device security matters equally—ensure smartphones and computers employ current operating systems with the latest security patches installed. Antivirus software provides additional protection layers against malware attempting to capture keystrokes or screenshots during login sessions.

Step-by-Step: How to Register (for first-time online access)

Who Needs to Register

Physical card possession doesn’t automatically grant online access to your TSC® credit card account. New cardholders recently approved through in-store or online applications must complete separate registration establishing digital credentials. This disconnect sometimes confuses customers assuming card activation simultaneously enables portal access. The registration process creates unique User IDs and passwords independent from the account number embossed on your physical card. Existing customers who exclusively managed accounts through phone calls or mailed payments also require registration before accessing digital features.

The one-time registration investment unlocks permanent online management capabilities eliminating future dependencies on consumer payment center representatives. Delaying registration means continuing reliance on traditional methods like mailing payments to Tractor Supply payment addresses such as P.O. Box locations in Sioux Falls or Philadelphia. Early registration allows exploring the dashboard interface, understanding statement layouts, and configuring delivery/express payments attn preferences before urgent needs arise. Proactive setup prevents scrambling during emergencies when immediate account access becomes critical for disputing charges or expediting payments.

Registration Process

Locate the “Register” or “Set Up Online Access” button prominently displayed on the tsccard.accountonline.com homepage for initiating credit card account registration. This clearly labeled option distinguishes new user workflows from returning customer login processes. Clicking launches a multi-page enrollment wizard guiding you through required information collection. The interface design minimizes confusion by presenting one section at a time rather than overwhelming with comprehensive forms.

Provide your complete card number exactly as embossed across sixteen digits without spaces or dashes. The system validates this number against active Tractor Supply credit card accounts maintained in Citi databases. Enter your full legal name matching credit approval documentation and card imprint precisely. Middle initials matter—discrepancies trigger validation failures requiring correction. The last four digits of your Social Security Number verify your identity against original application details. Some implementations additionally request your date of birth or phone number for cross-referencing multiple data points.

Creating your User ID represents a personalization opportunity within system constraints. Choose memorable combinations between six and twenty characters incorporating letters and numbers. Avoid obvious choices like “tractor123” that hackers easily guess. The password creation demands greater creativity meeting complexity requirements including uppercase letters, lowercase characters, numbers, and special symbols. Effective passwords resemble “Tr@ct0rF@rm!2024” combining memorable phrases with character substitutions. Confirmation fields require retyping both credentials ensuring accuracy before database storage.

Email or mobile verification finalizes registration by confirming contact information accuracy. The system sends verification codes to provided addresses requiring entry within specified timeframes. This step prevents typos in email addresses that would block future communications from the help center. Successfully completing verification activates your online access immediately. The system often prompts setting security questions used for future password resets or identity confirmation during suspicious activity investigations.

| Registration Field | Information Required | Example Format |

|---|---|---|

| Card Number | 16-digit account number | 1234-5678-9012-3456 |

| Cardholder Name | Full legal name | John Michael Smith |

| SSN Last 4 | Final four Social Security digits | 6789 |

| Date of Birth | MM/DD/YYYY format | 05/15/1980 |

| User ID | Unique 6–20 characters | FarmSupply2024 |

| Password | Complex 8+ characters | Tr@ct0r!Farm24 |

| Valid email address | johnsmith@email.com | |

| Phone | 10-digit number | (555) 123-4567 |

What to Do After Successful Registration

Immediately following successful enrollment, explore the dashboard familiarizing yourself with navigation and available features. Update profile information ensuring mailing addresses reflect current residences for emergency card replacements if needed. Configure notification preferences selecting which alerts reach your email versus text messages. Payment alerts prevent missed due dates while transaction notifications flag unauthorized purchases quickly. These customizations transform generic interfaces into personalized financial management tools.

Establish payment preferences determining your preferred funding sources and scheduling options. Link checking accounts for seamless transfers when settling monthly balances. Consider enabling automatic minimum payments preventing late fees during busy seasons when manual management becomes challenging. Review the rewards program details understanding how purchases at Tractor Supply stores accumulate points or cash back. Some TSC credit cards offer enhanced earnings on specific categories like veterinary services or feed purchases.

Troubleshooting Registration

Card number rejection during registration typically stems from data entry errors or timing issues. Verify you’re entering the complete sixteen-digit sequence without transposing any numbers. Recently issued cards sometimes require twenty-four to forty-eight hours after activation before systems recognize them for online registration. Attempting enrollment too quickly after approval results in “card not found” errors. Waiting a full business day usually resolves these timing discrepancies as backend databases synchronize.

Identity verification failures frustrate cardholders convinced their information matches application details exactly. Tiny discrepancies cause rejection—extra spaces, incorrect middle initials, or mismatched ZIP codes all trigger security blocks. Review original application paperwork confirming the exact spelling and formatting used during credit approval processes. Name variations like “Bob” versus “Robert” prevent successful matching. Contact information changes since application submission require updating through customer service before online registration succeeds.

Persistent registration problems warrant contacting specialized support teams equipped to investigate backend database issues. Phone numbers for the help center appear throughout official Tractor Supply websites and printed materials accompanying new cards. Representatives access administrative tools bypassing standard registration workflows when technical glitches prevent normal completion. They manually establish online profiles linking your card to new credentials. Document any error messages exactly as displayed—specific codes help technicians diagnose problems faster during support calls.

Applying for a TSC Store Card via the Portal

Prospective customers explore Tractor Supply credit card offerings directly through the tsccard.accountonline.com portal even without existing accounts. The homepage features prominently displayed “Apply Now” calls-to-action directing non-cardholders toward application workflows. This integrated approach allows researching card benefits, comparing terms, and submitting applications without navigating multiple websites. The streamlined process appeals to busy rural customers managing farms and ranches who value efficiency.

Application forms request comprehensive personal and financial details enabling credit approval decisions. Expect providing your full legal name, current residential address, and phone number for verification purposes. Employment information including employer names, positions held, and gross annual income help assess repayment capacity. The system requires your complete Social Security Number for conducting credit bureau inquiries. Housing status questions determine whether you rent or own, factoring into overall financial stability evaluations.

Initial credit approval decisions often generate within minutes through automated underwriting algorithms. Instant approval notifications allow immediately planning purchases at nearby Tractor Supply stores. Conditional approvals require additional verification before final determination. Complete rejections explain reasons like insufficient credit history or excessive existing debt obligations. Approved applicants receive cards via postal mail at addresses provided during applications within seven to ten business days.

Upon receiving your physical TSC® credit card, activate it following enclosed instructions before attempting purchases. Activation connects the embossed card number with your approved account in processing systems. Immediately afterward, return to tsccard.accountonline.com and complete registration as described in previous sections. Early online enrollment establishes digital habits preventing future reliance on less convenient payment methods. The card unlocks numerous benefits including special financing offers on qualifying purchases, exclusive cardholder discounts, and rewards accumulation across Tractor Supply categories.

TSC credit card advantages extend beyond basic purchasing power. Promotional financing options defer interest charges on large equipment purchases when paid within specified timeframes. These offers prove invaluable during expensive seasons like spring planting or fall harvesting requiring significant capital investments. Enhanced rewards rates apply to categories frequent rural customers utilize most—veterinary services, livestock feed, fencing materials, and seasonal supplies. Some card tiers offer extended benefits at partner locations including participating gas stations and grocery stores serving agricultural communities.

Features & Benefits of Online Account Management

Convenience revolutionizes how Tractor Supply credit card holders interact with their financial obligations. The tsccard.accountonline.com portal operates continuously without restrictions imposed by business hours or geographic locations. Late-night account checks don’t require waiting until morning when customer service centers open.

Weekend payment submissions process normally despite banks observing traditional closures. This perpetual availability accommodates irregular schedules common among farmers, ranchers, and rural homeowners whose responsibilities rarely conform to standard workdays.

Accessing accounts from any internet-enabled device eliminates dependencies on specific computers or locations. Smartphones transform into portable banking terminals capable of managing payments from barn aisles or feed store parking lots. Tablet devices offer larger screens improving readability of detailed transaction histories and statement documents. Desktop computers provide comprehensive interfaces ideal for thorough account reviews and complex payment scheduling. The responsive design automatically optimizes layouts matching device capabilities without requiring separate applications.

Efficiency gains manifest through immediate statement visibility compared to postal delivery delays. Cardholders review purchases instantly rather than waiting days for printed summaries arriving via traditional mail.

The immediacy enables catching billing errors or fraudulent charges while memories remain fresh. Downloading digital statements takes seconds compared to filing physical papers prone to damage or loss. Transaction searches filter by date ranges, merchant names, or amount thresholds locating specific purchases without manually reviewing pages of printed records.

Payment processing speed eliminates anxieties about checks lost in transit or delayed processing causing late fees. Electronic fund transfers complete within one to two business days compared to weekly mail times. Confirmation numbers generate immediately providing proof of submission if disputes arise regarding payment timeliness. Scheduled payments automate repetitive monthly obligations freeing mental bandwidth for more critical farm management decisions. The automation particularly benefits during harvest seasons when time becomes the scarcest resource.

Security enhancements through digital management reduce risks associated with physical document handling. Mailed statements potentially expose account numbers and balances to theft if intercepted from unsecured mailboxes. Digital archives secured behind password-protected accounts offer superior privacy protections. Early detection of unauthorized activity becomes possible through frequent login habits impossible with monthly paper statement cycles. Transaction alerts notify suspicious purchases within hours rather than weeks after fraudulent card usage.

Additional functionalities enrich experiences beyond basic balance inquiries and payment submissions. Transaction categorization automatically sorts spending across types like veterinary services, equipment, or supplies aiding budget analysis. Spending reports visualize monthly patterns helping identify opportunities for expense reduction.

Paperless billing enrollment contributes environmental benefits while simplifying recordkeeping. Statement downloads integrate smoothly with personal finance software for comprehensive household budget tracking. These augmented capabilities transform simple credit cards into sophisticated financial management instruments.

| Online Management Benefit | Traditional Method Limitation | Time/Cost Savings |

|---|---|---|

| Instant statement access | 5–7 day postal delivery | Saves 1 week wait time |

| 24/7 account availability | Business hours phone service | Eliminates schedule conflicts |

| Immediate payment processing | Check mail time + processing | Reduces payment time by 7–10 days |

| Digital transaction search | Manual paper statement review | Saves 15–30 minutes per search |

| Automated payment scheduling | Manual monthly check writing | Saves 10 minutes monthly |

| Real-time fraud detection | Monthly statement review | Catches fraud weeks earlier |

| Secure digital storage | Physical document filing | Eliminates storage space needs |

Cost savings emerge through eliminated expenses for checks, envelopes, and postage stamps. Frequent payments avoiding interest charges by settling balances bi-weekly rather than monthly accumulate substantial savings. Avoiding late fees through automated reminders and scheduled payments preserves hundreds annually. The time reclaimed from manual payment processes compounds when calculated across years of card ownership. These seemingly small efficiencies collectively represent meaningful value for budget-conscious rural households.

Security & Safety Considerations

Confirming the Legitimacy of the Site

Verifying you’re accessing the authentic tsccard.accountonline.com domain requires vigilance against increasingly sophisticated phishing operations. Cybercriminals craft convincing replica sites hoping distracted users surrender credentials without scrutinizing URLs carefully. Always manually type the web address rather than clicking links embedded in unsolicited emails claiming urgent account problems. Bookmarking the legitimate portal after initial verification eliminates future risks of typographical errors directing you toward malicious sites.

The padlock icon appearing in browser address bars confirms secure HTTPS connections encrypting data transmissions. Clicking this symbol reveals certificate details identifying the issuing authority and domain owner. Legitimate Tractor Supply credit card portals display certificates issued to Citi Retail Services or related entities. Mismatched certificates showing unrelated company names signal fraudulent sites attempting credential harvesting. Modern browsers highlight security warnings when encountering invalid certificates or suspicious domains.

Domain age investigations occasionally reveal concerning patterns about newly registered sites mimicking established portals. While the primary tsccard.accountonline.com maintains long operational histories, phishing variants appear using similar names with slight variations. Anonymous WHOIS registration protecting owner identities sometimes accompanies legitimate operations but more frequently indicates nefarious intentions. Cross-referencing domain information against official Tractor Supply communications confirms authenticity when doubts arise. Customer service representatives readily verify whether specific URLs belong to authorized card management infrastructure.

Recommended Practices

Strong password construction forms the foundation of account security beyond portal-level protections. Avoid reusing passwords across multiple financial accounts—unique credentials contain breaches preventing cascading compromises. Effective passwords combine random words with numbers and symbols creating memorable phrases resistant to dictionary attacks. Examples like “BlueTr@ctor!F@rm2024” incorporate personal elements while satisfying complexity requirements. Password managers securely store these complex credentials eliminating needs to write them physically where others might discover them.

Two-factor authentication activation adds critical security layers even when passwords become compromised. Enabling this feature requires possessing both your password and temporary access to registered phone numbers or email accounts. Hackers stealing passwords through phishing cannot complete logins without also controlling your mobile device. The minor inconvenience of entering verification codes dramatically reduces unauthorized access risks. Most portals offer options to trust recognized devices, reducing authentication frequency on personal computers while maintaining protection from unfamiliar locations.

Regular account monitoring detects fraudulent activity before substantial damage accumulates. Weekly login habits allow spotting unauthorized purchases quickly rather than discovering problems during monthly statement reviews. Transaction alerts configured to notify all card usage provide real-time awareness of account activity. Immediately reporting suspicious charges enables rapid card deactivation and fraud investigation initiation. The sooner issues surface, the easier resolving them becomes with minimal financial impact.

Public WiFi avoidance prevents interception of login credentials transmitted across unsecured networks. Coffee shops, libraries, and airports frequently offer convenient internet access but lack encryption protecting transmitted data. Criminals operating on these networks employ packet sniffing tools capturing passwords typed by unsuspecting users. Cellular data connections provide superior security for accessing financial accounts when away from trusted home or office networks. Virtual private networks encrypt all traffic even across public WiFi but require monthly subscriptions and technical configuration knowledge.

Session logout habits prevent unauthorized access from shared devices or after stepping away briefly. Browsers cache login sessions allowing immediate account access without re-entering credentials. Forgetting to log out from library computers or work terminals exposes accounts to subsequent users. Manual logout buttons appear prominently on portals—clicking them terminates active sessions requiring fresh authentication for future access. This simple discipline protects against opportunistic access from others using the same device.

Email scrutiny prevents falling victim to phishing messages impersonating Tractor Supply or Citi Retail Services. Legitimate communications never request passwords or full card numbers through email messages. Suspicious emails often contain grammatical errors, threatening language about account closures, or links to domains resembling but not matching official addresses. Hovering over links before clicking reveals actual destinations in browser status bars. When doubting email authenticity, navigate directly to tsccard.accountonline.com rather than clicking embedded links.

What to Do If You Suspect Fraud

Immediate action upon detecting unauthorized purchases minimizes financial liability and prevents additional fraudulent charges. Contact TSC credit card customer service using phone numbers printed on the back of your card or listed on official Tractor Supply websites. Representatives freeze accounts instantly while investigating suspicious activity. The temporary freeze prevents further charges until determining whether transactions were legitimate or fraudulent. Most issuers provide zero-liability protections ensuring cardholders don’t pay for confirmed unauthorized purchases.

Password changes following potential compromises reestablish account security assuming attackers haven’t modified access credentials already. Create completely new passwords unrelated to previous versions—incrementing numbers or adding characters provides insufficient protection. Comprehensive transaction reviews identify the full scope of fraudulent activity rather than focusing solely on initial discoveries. Fraudsters often make small test purchases before attempting larger transactions hoping minor charges escape notice. Document all suspicious transactions with dates, amounts, and merchant names assisting investigators.

Credit bureau notifications add protective layers when suspecting identity theft extends beyond single card compromises. Fraud alerts placed with Equifax, Experian, and TransUnion flag your credit file requiring additional verification before new account openings. These alerts prevent criminals from opening additional credit cards or loans using stolen identity information. Credit monitoring services track changes to credit reports, notifying new inquiries or account openings immediately. The heightened scrutiny helps contain damage from sophisticated identity theft operations.

Common Issues & How to Solve Them

Login Failures

Wrong credential entries represent the most frequent account access problems plaguing even careful users. Password case sensitivity means “Tractor123” differs from “tractor123” entirely—one capitalization error triggers rejection. User IDs similarly require exact spelling and capitalization matching original registration details. Several consecutive failures activate temporary lockouts protecting accounts from brute-force hacking attempts. These security measures frustrate legitimate users but provide essential protections against automated attack systems.

Solutions begin with carefully retyping credentials while consciously verifying each character before submission. Password reveal buttons temporarily display masked characters helping identify typing errors. Alternatively, paste credentials from password managers eliminating manual entry mistakes. Forgotten passwords require initiating reset workflows accessible through “Forgot Password” links. Locked accounts demand patience waiting for automatic unlocks or contacting customer service for manual intervention. Representatives verify identity through account-specific questions before releasing security holds.

Registration Problems

Card number recognition failures during registration workflows commonly stem from recent account activation. Backend systems require synchronization time ranging from several hours to full business days after new card approvals. Attempting registration too quickly results in frustrating “card not found” errors despite holding physical cards. Waiting forty-eight hours after card activation typically resolves these timing-related problems. Persistent recognition failures after adequate waiting periods suggest data entry errors or system glitches requiring customer service assistance.

Identity verification rejections occur when provided information doesn’t precisely match original application details. Typos in names, transposed Social Security Number digits, or incorrect dates of birth all trigger security failures. Carefully review application paperwork confirming exact spellings and formats used during credit approval processes. Name variations between legal documents and applications cause matching failures—”William” versus “Bill” or “Robert” versus “Bob” prevent successful verification. Address changes between application submission and registration attempts similarly create database mismatches requiring updates through customer service channels.

Payment Issues

Website downtime occasionally prevents payment submissions during critical periods approaching due dates. Scheduled maintenance windows and unexpected technical problems temporarily disable portal functionality. Alternative payment methods provide backup options during these frustrations. Phone payments through automated systems or customer service representatives accept submissions when websites malfunction. Mailing checks to designated payment addresses like P.O. Box locations in Sioux Falls (57117-6403) or Philadelphia (Del 19176-0602) ensures timely processing despite digital obstacles.

Processing errors during successful payment submissions generate anxiety about whether funds transferred correctly. Confirmation numbers and email receipts provide verification of completed transactions. Banking accounts show pending debits within one to two business days confirming fund withdrawals. Credit card balances update reflecting payments within similar timeframes. Contacting customer service with confirmation numbers resolves uncertainties through representative verification of successful processing. Representatives access backend systems tracking payment statuses invisible to cardholders through standard portal interfaces.

Browser and device compatibility problems manifest as formatting issues, non-functional buttons, or incomplete page loading. Outdated browsers lack security protocols required for modern financial portals. Updating to current versions resolves most compatibility issues immediately. Clearing cached files and cookies eliminates corrupted data interfering with proper website rendering.

Disabling browser extensions temporarily helps identify conflicts with ad blockers, password managers, or security plugins. Testing different browsers—Chrome, Firefox, Safari, or Edge—determines whether problems stem from specific browser quirks or broader device issues. Mobile app alternatives sometimes bypass browser-related obstacles entirely when available for TSC credit cards.

Account Shows Incorrect Info

Balance discrepancies appearing on dashboards cause understandable alarm when numbers don’t match expectations or recent calculations. Pending transactions not yet finalized explain many apparent errors since authorization holds differ from final settled amounts. Gas station purchases commonly authorize higher amounts than actual pump totals, releasing excess holds within several days. Restaurant charges initially appear without tips, updating later when merchants submit final totals including gratuity. Patience while transactions settle from pending to posted status resolves most balance confusion.

Missing transactions or charges attributed to unfamiliar merchants require investigation through customer service channels. Representatives access detailed merchant information invisible through standard portal views. Cryptic descriptor names often hide familiar businesses—”TSC #4521″ might represent specific Tractor Supply stores locations rather than displaying full company names. Transaction dates sometimes reflect processing times rather than actual purchase dates, creating apparent timeline discrepancies. Representatives correlate transaction details with your purchase history identifying legitimate charges disguised by technical processing nomenclature.

Duplicate charges appearing on statements warrant immediate dispute initiation rather than assuming system errors correct automatically. Merchants occasionally submit transactions twice through processing errors or deliberate fraud. Cardholders bear responsibility for identifying and reporting these discrepancies promptly. The card agreement specifies timeframes for disputing charges, typically sixty days from statement dates. Missing these deadlines forfeits dispute rights even for obvious errors. Documentation including receipts, purchase confirmations, and correspondence with merchants strengthens dispute cases significantly.

Statement periods reflecting incorrect date ranges suggest synchronization problems between display systems and actual billing cycles. Refreshing browser pages and clearing cache files sometimes resolves display glitches showing outdated information. Logging out completely and re-authenticating forces systems to retrieve current data from primary databases. Persistent inaccuracies across multiple sessions and devices indicate genuine database problems requiring technical support intervention. Representatives escalate these issues to backend administrators possessing tools to correct underlying data corruption.

FAQs (Frequently Asked Questions)

What is tsccard.accountonline.com used for?

The portal serves as the comprehensive digital management hub for Tractor Supply credit card holders seeking convenient account oversight. Cardholders log in to view current balances, review transaction histories, submit payments, and manage personal information. The platform replaces traditional methods like telephone banking and mailed statements with instant online access. Both TSC store card holders and TSC® credit card users rely on this portal for everything from one-time payment submissions to establishing recurring payment schedules. New customers apply for cards through integrated application workflows accessible without existing accounts.

Is it safe to log in from my smartphone or tablet?

Mobile device access provides secure account management when following basic digital hygiene practices. The responsive website design automatically optimizes for smaller screens without compromising encryption protocols protecting transmitted data. Ensure your smartphone or tablet runs current operating system versions with latest security patches installed. Avoid public WiFi networks when accessing financial accounts, preferring cellular data connections offering superior privacy. Password-protecting devices themselves prevents unauthorized access if phones or tablets fall into wrong hands. Biometric authentication like fingerprint or face recognition adds convenient security layers for mobile banking activities.

What if I forgot my User ID or Password?

Recovery workflows accessible through “Forgot User ID” and “Forgot Password” links guide you through identity verification processes. User ID recovery requires providing your card number, full name matching account records, and potentially additional identifying information like dates of birth. The system emails recovered User IDs to addresses registered during initial enrollment. Password resets demand more stringent verification including security question answers and confirmation codes sent to registered phone numbers or email addresses. Successfully completing these challenges allows creating new passwords meeting current complexity requirements. Persistent recovery failures necessitate contacting customer service for manual assistance.

Can I pay my bill via the portal?

Payment submission represents one of the portal’s primary functions utilized by thousands daily. The dashboard prominently features payment options accepting various funding sources including checking accounts, savings accounts, and debit cards. Schedule one-time payment transactions for immediate processing or establish recurring automatic payments preventing missed due dates. The system displays minimum payment amounts alongside full statement balances helping you decide appropriate payment levels. Confirmation numbers generate instantly upon successful submission providing proof for financial records. Processing completes within one to two business days, updating account balances and preventing late fees.

How do I view past statements?

Statement archives accessible through dedicated menu options preserve months of billing history in downloadable PDF formats. Navigate to the “Statements” or “Documents” section after logging in to view chronological listings of previous billing cycles. Click individual statement dates to open complete documents showing all transactions, fees, rewards earned, and payment information. Download options save statements to devices for offline reference or integration with personal finance software. Some portals allow searching statements by date ranges or transaction amounts locating specific purchases without manually reviewing entire documents.

Can I apply for a new TSC Store Card using this site?

Prospective customers explore card offerings and submit applications directly through the tsccard.accountonline.com portal without existing accounts. The homepage features “Apply Now” buttons directing non-cardholders toward application workflows. Comprehensive forms collect personal, employment, and financial information enabling credit approval decisions. Automated underwriting systems often provide instant approval notifications within minutes of submission. Approved applicants receive physical cards via mail within seven to ten business days. Upon card receipt, return to the portal completing registration to establish online access for future account management.

What are the fees associated with the card?

Fee structures vary depending on specific TSC credit card products and individual credit approval terms. Annual fees might apply to premium card tiers offering enhanced rewards or benefits, while basic store cards typically charge zero annual costs. Late payment fees assess when minimum payments aren’t received by due dates, usually ranging from twenty-five to forty dollars. Returned payment fees apply when funding sources lack sufficient funds to complete transactions. Interest charges accumulate on carried balances according to annual percentage rates disclosed in card agreement documents. Some promotional financing offers defer interest charges on qualifying purchases when paid within specified timeframes. The minimum interest charge might apply even when balances carry minimal interest under certain terms.

How do I sign up for paperless billing?

Paperless enrollment through account settings eliminates physical statement mailings while maintaining complete digital access. Navigate to profile or preferences sections after logging in, locating options labeled “Paperless Billing” or “eStatements.” Activate the feature by confirming your email address receives statement notifications when new documents publish. The system sends email alerts on statement closing dates with links directly to view current billing cycles. Digital archives preserve paperless statements identically to traditional versions with complete transaction details and payment information. Environmental benefits accompany the convenience of eliminating paper waste from monthly statement production and postal delivery.

Conclusion

The tsccard.accountonline.com portal revolutionizes how Tractor Supply credit card holders interact with their financial obligations through secure, convenient digital access. This comprehensive platform eliminates frustrations associated with traditional banking methods like delayed postal delivery and restrictive business hours. Cardholders gain unprecedented control over accounts through features enabling instant balance inquiries, flexible payment scheduling, and detailed transaction analysis. The partnership between Tractor Supply and Citi Retail Services delivers enterprise-grade security protecting sensitive financial data while maintaining intuitive interfaces accessible across devices.

Successful portal utilization demands vigilance regarding security best practices alongside understanding available features. Always verify you’re accessing the correct URL at https://tsccard.accountonline.com to avoid phishing schemes harvesting credentials through replica sites. Strong, unique passwords combined with two-factor authentication provide robust protections against unauthorized access attempts. Regular login habits enable early detection of fraudulent activity before substantial damage accumulates. The investment in proper registration and security configuration pays dividends through years of streamlined account management.

Prospective customers considering TSC store card applications discover compelling benefits extending beyond basic purchasing power. Promotional financing offers defer interest on major equipment purchases when terms satisfy payment requirements. Enhanced rewards rates apply to categories rural customers frequent most—veterinary services, livestock feed, and agricultural supplies. The card functions at participating partner locations including select gas stations and grocery stores serving farming communities. Digital account management through the portal maximizes these benefits while minimizing administrative burdens.

Regular account monitoring through the portal establishes healthy financial habits preventing common pitfalls like missed payments or unnoticed fraudulent charges. Configure transaction alerts notifying suspicious activity immediately rather than waiting for monthly statement reviews. Explore spending reports and transaction categorization tools identifying opportunities for budget optimization. Enable paperless billing contributing environmental sustainability while simplifying recordkeeping processes. These proactive approaches transform credit cards from mere payment instruments into comprehensive financial management tools.

Technical difficulties occasionally disrupt even well-designed portals, but solutions exist for virtually every common problem. Bookmark the official URL preventing typographical errors directing you toward malicious sites. Maintain updated browsers supporting current security protocols required for encrypted connections. Keep customer service contact information readily accessible for situations exceeding self-service troubleshooting capabilities. The help center representatives possess administrative tools resolving complex issues impossible to address through standard portal interfaces. Their expertise proves invaluable during account emergencies requiring immediate intervention.

The digital transformation of retail credit management continues evolving with enhanced features regularly added to portals like tsccard.accountonline.com. Cardholders embracing these technologies position themselves for maximum convenience as capabilities expand. Future enhancements might include advanced budgeting tools, integrated rewards redemption, or expanded partner benefits. Staying engaged with your account through regular portal visits ensures you don’t miss announcements about new features or special promotional offers exclusive to active digital users.

If uncertainty arises regarding any link, email, or communication claiming association with your TSC credit card, verify authenticity directly through official Tractor Supply channels before responding. Navigate independently to known-good websites rather than clicking embedded links in suspicious messages. Contact customer service using phone numbers printed on your physical card or listed on official corporate websites. This cautious approach protects against increasingly sophisticated social engineering attacks targeting financial account credentials. Your vigilance represents the final defense layer beyond technical security measures implemented by financial institutions.

The convenience, security, and comprehensive functionality offered through tsccard.accountonline.com make it indispensable for modern Tractor Supply credit card management. Whether you’re a longtime cardholder transitioning from traditional methods or a new customer establishing initial online access, the portal delivers value through every interaction. Commit to regular engagement, maintain robust security practices, and explore all available features maximizing your card’s potential. The small investment in learning portal navigation yields substantial returns through years of efficient, secure financial account oversight supporting your rural lifestyle and agricultural endeavors.

I’m Watson, a faith-inspired writer passionate about sharing heartfelt blessings and uplifting words that bring peace, gratitude, and hope. Through my daily blessings, I aim to comfort the soul and inspire spiritual growth.